May 30, 2024

Guiding Your ISO 20022 Adoption Journey

The global payment landscape is undergoing a profound transformation with the adoption of ISO 20022 standards and Cross-Border Payments and Reporting Plus (CBPR+) usage guidelines. This revolutionary shift not only brings forth promising innovations but also presents significant challenges for financial institutions, particularly those in emerging economies, who must navigate complexities in collaboration with central banks to ensure seamless migration and foster economic growth.

ISO 20022 Standards: Advantages and Challenges

ISO 20022 is an internationally recognized data standard embedded within the CBPR+ specification. It offers comprehensive usage guidelines for ISO 20022 in cross-border payments and cash reporting across the Swift network.

The implementation of ISO 20022 brings forth numerous advantages, such as enhanced financial crime compliance, improved customer experience and streamlined payment investigation. However, it also presents a myriad of challenges, particularly noticeable in developing countries that might hinder its adoption:

- Fragile banking infrastructure and varying priorities

- Substantial migration costs

- Uncertainty and significant risks at both the institutional and national levels

- Potential impact on reserve and liquidity management

- Difficulty in accessing central bank funds

The Responsibility of Central Banks

As of November 2025, the Swift legacy MT standard will cease to exist, necessitating urgent action from financial institutions worldwide. Accordingly, the involvement of central banks and regulators, in both developed and emerging economies, is crucial in guiding financial institutions through the migration process to ISO 20022 and ensuring their compliance within set deadlines.

Many financial institutions have initiated the transition from the Swift MT messaging format to the more structured and data-rich MX format. This transition aims to improve interoperability between domestic and international payments and ensure a consistent and seamless experience for customers across different banking channels. However, the pace of migration varies widely from one country or region to another, reflecting the diverse realities and priorities of each jurisdiction. In response to this variation, some countries have opted to adopt ISO 20022 standards not only for cross-border payments but also for their domestic or regional clearing and settlement systems.

To mitigate risks and ensure a seamless adoption of ISO 20022 standards, it is vital to underscore the responsibility placed on both financial institutions and, more significantly, central banks in coordinating and facilitating this migration process. Across numerous nations, central banks have proactively embraced national migration programs or implemented guidelines and deadlines to encourage financial institutions to adopt these new standards.

For instance, as part of the Central Bank of the UAE nation's broader strategy to modernize its financial infrastructure and support the growth of its digital economy, it has been actively working on migrating to ISO 20022 for all domestic and cross-border payments. Similarly, several African nations, such as South Africa, Kenya, and Nigeria, are currently considering or implementing ISO 20022 migration initiatives.

ISO 20022 Standards Adoption Approaches

Given the magnitude and urgency of this undertaking, various countries and institutions have developed distinct migration strategies, each accompanied by its own set of opportunities and challenges. Below is an overview of each approach:

The Converter: Accelerating Migration

Given the urgency, some institutions may consider shortcuts, such as a translation and data management solution. A “converter” placed at the inlets and outlets of the payments process can be used to convert incoming MX messages into equivalent legacy MT formats, as well as convert outgoing MT messages into equivalent MX formats and support required reporting and confirmation messages.

While it is important to understand its limitation, this option will enable a prompt adoption of ISO 20022 with minimal changes to the existing payment infrastructure and can be considered as an intermediary phase toward the native adoption of the new standard.

The CBPR+ Native Implementation: Full-scale Adoption

The long-term option involves selecting a CBPR+ compatible solution, necessitating thorough planning and budget allocation. Although it requires additional resources upfront, this approach offers substantial benefits. It allows for the comprehensive utilization of ISO 20022 standards, facilitating the seamless initiation, processing and receipt of CBPR+ messages in accordance with Swift regulations. By adopting this implementation model, financial institutions can provide enhanced services to the market and their customers, ensuring competitiveness and long-term viability.

The Hybrid: Tailored Flexibility

This approach offers financial institutions the flexibility to migrate a portion of CBPR+ messages using a converter while implementing native CBPR+/ISO 20022 for others. With this method, financial institutions can strategically decide when to transition CBPR+ messages from the converter to native implementation based on their priority roadmap or specific market requirements.

While providing a smooth and adaptable adoption plan, both at the bank and national level, this option may introduce administrative and operational complexities depending on the institution's priorities.

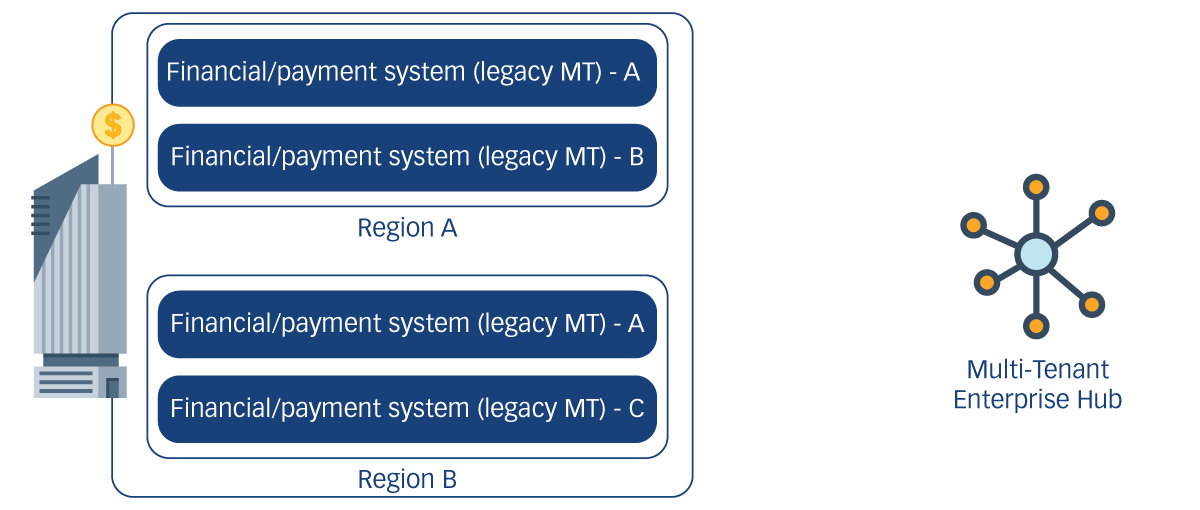

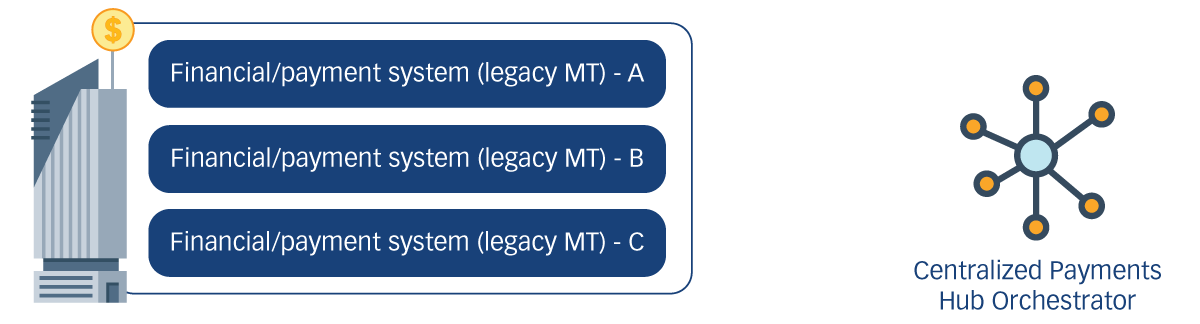

The Payments Hub Orchestrator: Optimal Choice

This platform serves as a pivotal intermediary between a financial institution's internal systems and the external financial landscape. Incorporating all previously mentioned options, along with additional features, it enables the consolidation of necessary changes into a singular, optimized process. This eliminates redundant efforts and aligns the institution with the best practices in the payments realm, facilitating seamless adoption of CBPR+ guidelines, enhancements and updates.

Figure 1: Payments Hub Orchestrator

Furthermore, a payments hub platform can be deployed using a multi-tenant model, providing the capability to serve and manage multiple financial institutions by central banks, or through a centralized service where financial institutions can subscribe and customize their integrations. This offers central authorities enhanced monitoring and reporting capabilities. Additionally, this approach fosters nationwide adoption and updates of the standard.

Figure 2: Payments Hub Orchestrator - Multi-tenant model

While this option may require additional initial investment, many financial institutions and central banks opt for it following a thorough cost-value analysis during the assessment phase.

The ISO 20022 Migration Strategy Guide

Selecting the appropriate migration approach is essential for a seamless adoption of ISO 20022. This demands a well-defined migration strategy and clear objectives. Considering the following aspects provides guidance through this crucial process:

Market Infrastructure Alignment: Financial institutions must assess their connections to market infrastructure, prioritizing challenges identified through comprehensive evaluation.

Strategic Timeline Evaluation: Financial institutions should consider the timeline for migration, whether for the entire architecture or by utilizing tactical workarounds. Moreover, they should recognize differences in implications for national-scale versus institutional-level migration initiatives.

Engagement with Industry Experts: Financial institutions should engage with industry experts and CBPR+ ready providers to ensure alignment with their product roadmap and migration objectives.

Stakeholder Communication Strategy: Financial institutions should establish effective communication with stakeholders to clearly articulate the impact of migration and offer support as needed.

Conclusion

Each country or region is progressing through the migration process at its own pace, driven by unique local challenges and priorities. It is vital to reemphasize the role of central banks and regulators in guiding financial institutions and ensuring compliance with the new standard through the appropriate approach.

Despite the meticulous planning and significant investments required for ISO 20022 adoption and migration, the opportunities are wide open to act promptly. Early action can lead to substantial benefits, including standardized processes, enhanced end-to-end efficiency in payments operations, controlled investment and comprehensive inclusion of all stakeholders in the payment ecosystem.

The transition to ISO 20022 marks a historic opportunity for the industry, heralding remarkable advancements. However, it also presents significant challenges that must be navigated with utmost precision and foresight.

Related Products