October 15, 2024

Managing Customer Disputes in Retail Payments

Central banks and national payment companies worldwide have been striving to improve their payment market infrastructure and launch a bouquet of domestic and regional payment systems with innovative payment methods, aiming to reduce reliance on any single payment system or network and make payments ubiquitous and affordable for everyone.

Meanwhile, even corporate and government agencies have been investing heavily in digital transformation by leveraging the variety of payment infrastructure available to make the customer experience seamless and instantaneous, with emphasis on Straight-Through Processing (STP). This has helped organizations significantly improve operational efficiency and reduce costs.

The participation of fintechs and payment service providers in the payment landscape has also created positive impact by bringing innovation and efficiency to payment processing.

Relevance of Dispute Frameworks

While the benefits of payment innovation have been evident in the overall service delivery, the new payment rails involving additional participants in the payment journey has exposed stakeholders in the ecosystem to new challenges. One such challenge is the handling of customer grievances and disputes.

Payment disputes raised by customers are typically less than one percent of total transactions processed, but these incidents can have an enormous effect on customer relationships and their confidence in the payment network. For customers, disputes are a source of frustration and inconvenience, while for central banks and other financial institutions, disputes are time-consuming and expensive operational overheads that pose a threat to their reputation.

While card payments have long had an established dispute resolution framework governed by card schemes and domestic switch operators, such a framework was not considered essential for other retail payment systems. However, with increased complexity, multiple national payment systems and additional actors in the payment ecosystem, it has become crucial for central banks to implement a common dispute management framework that can integrate with multiple payment systems and adapt to flexible rules of operation.

Emergence of New Business Cases

Let us explore some of the most critical and recent business cases that highlight the need for robust dispute management frameworks:

- The use of instant payment rails is increasing globally; it has become a popular and convenient payment option for customers and businesses alike. With the growing use for merchant and corporate payments, a dispute management framework becomes a necessity and not a luxury anymore.

- Modern Automated Clearing House (ACH) systems across the globe are now processing complex payments beyond just credit transfers. They now support direct debit payments with mandates that can be revocable or non-revocable; a service widely used by financing and utility companies to process customers’ bulk and recurring payments. This has led to more frequent customer disputes arising from such payments.

- Open Banking frameworks are being developed in many countries to promote innovation in payment and banking services, with that, numerous additional stakeholders will now be involved in the processing of payments via new payment market infrastructures. This will be a new source of customer disputes.

Essentials of a Robust Framework

When the central bank or national payment company is developing a dispute management framework, they need to ensure that it provides them with enough flexibility to define the following:

- A dispute criteria and deadline for each payment system

- Different dispute treatments based on transaction type

- Turnaround Time (TAT) for each action in the dispute lifecycle

- Maintenance of the complete case history along with the attachments and transaction details

- Configuration of auto-accept/auto-reject on expiry of TAT

- Provision to define good faith collection for transactions outside the dispute management rules

- Triggered financial posting on user acceptance and auto-acceptance of disputes

- Exposed Application Programming Interfaces (APIs) for the ecosystem partners to achieve straight-through processing and minimize manual intervention by financial institutions

Ecosystem Setup

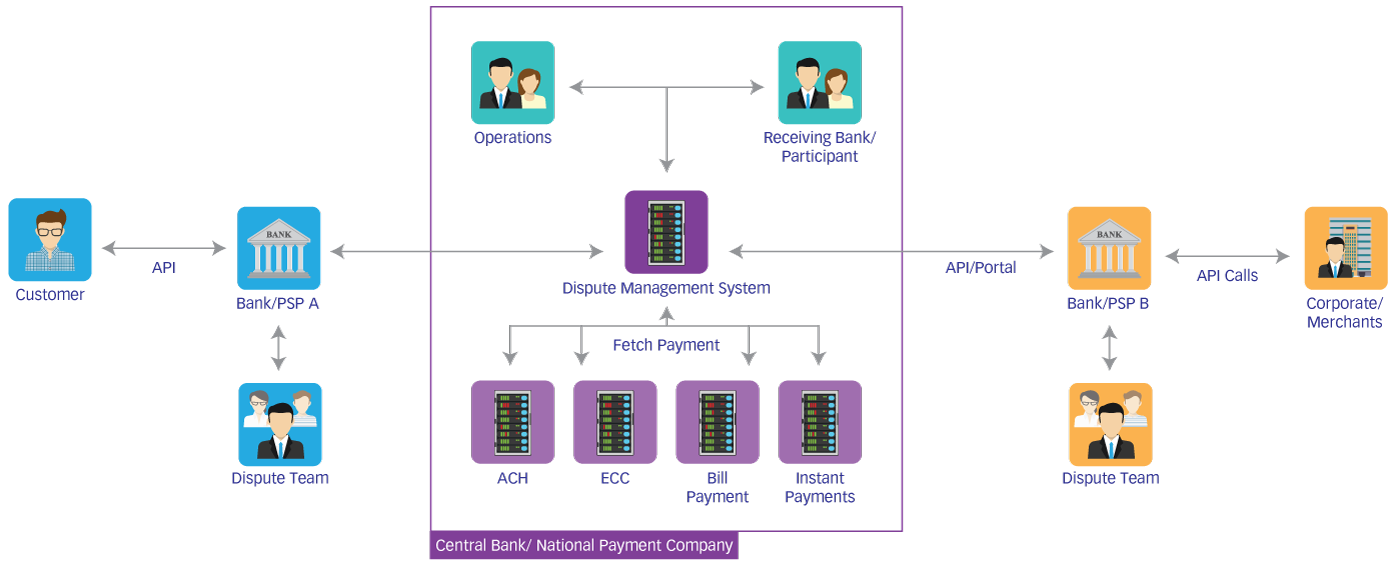

The following image depicts a typical ecosystem setup in which a dispute management system operates. This set up is usually tweaked according to the ownership and governance model of the payment market infrastructure.

Conclusion

An effective dispute management framework is essential in today's financial landscape for enhancing operational efficiency by streamlining processes and minimizing delays in resolving disputes. This efficiency not only benefits the central banks or national payment companies but also improves the overall user experience for customers, who expect fair resolutions to their issues. When customers feel confident that their disputes will be handled promptly and transparently, their trust in the payment infrastructure increases, leading to higher usage and satisfaction rates.

Moreover, a robust dispute management framework fosters a culture of innovation within the country’s financial ecosystem. By providing clear guidelines and flexibility in managing disputes, financial institutions are encouraged to explore new technologies and service offerings. This innovation is vital as it allows for the development of more customer-centric solutions.