August 30, 2020

Payment Solutions: Will You Make It or Break It?

If we take a look at industry leaders today, whether in tech or industrial fields, and look into the reasons behind their huge success, we will find that they all have one thing in common; they are customer-driven companies.

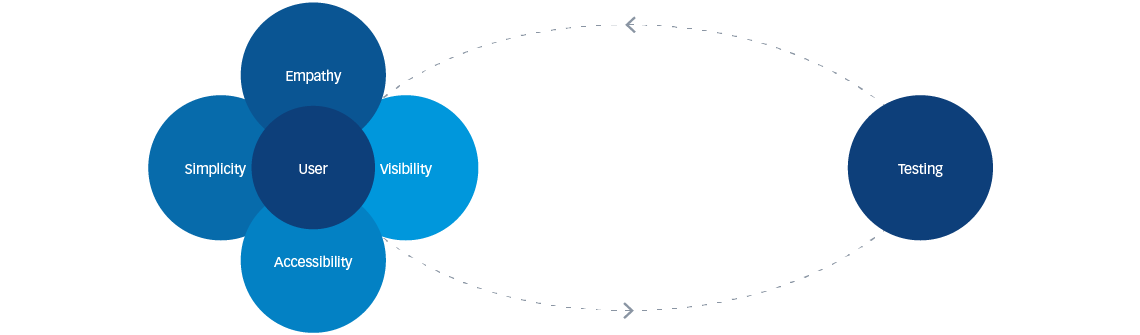

Such customer-driven companies often adopt a design-driven approach. While being customer-driven means ensuring that all aspects of the company put its customers first, adopting a design-driven approach means ensuring that all aspects of a digital product or service put its users first.

Companies that adopt a design-driven approach utilize User-Centered Design (UCD) where usability goals, user characteristics, user journeys, tasks and workflows of a product or service are given extensive attention at each stage of the process. According to Econsultancy’s 2018 Digital Trends for Creative and Design Leaders Report, these companies are almost twice as likely to be significantly outperforming their competitors.

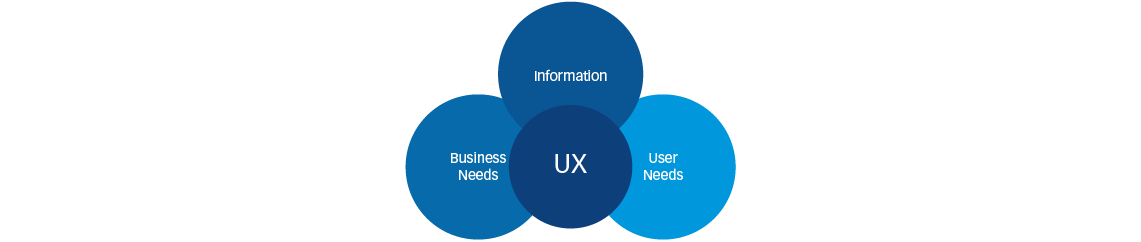

Figure 1: User-Centered Design

And the case for the financial industry is no different.

Banking and payment solutions are evolving rapidly and becoming more complex, with new innovations used to target specific customer types, banks, financial institutions, corporations, or all end-users. These solutions are used by either personnel at financial institutions such as check scanning systems, or by end-users utilizing a mobile banking application as an example.

However, payment and banking solution developers are more focused on security and functionality rather than design and user experience, and in this case, the solution is only half-way ready as users today not only expect just functional and secure applications, but in fact demand easy and convenient features too.

Users, whether they are financial institution employees or customers, demand simple and user-friendly products to achieve their needs. For example, if a bank teller is presented with a solution that contains unnecessary text fields or hidden actions, their cognitive load will be increased, ultimately resulting in slower productivity, longer queues and reduced customer satisfaction.

Another example is a mobile banking application, which has become the main banking interface used by customers due to its wide range of offered services, great options for personalization and massive convenience. The design of the mobile banking application in this case, needs to serve all customer personas, whether they are young or old, and it must be user-friendly for all.

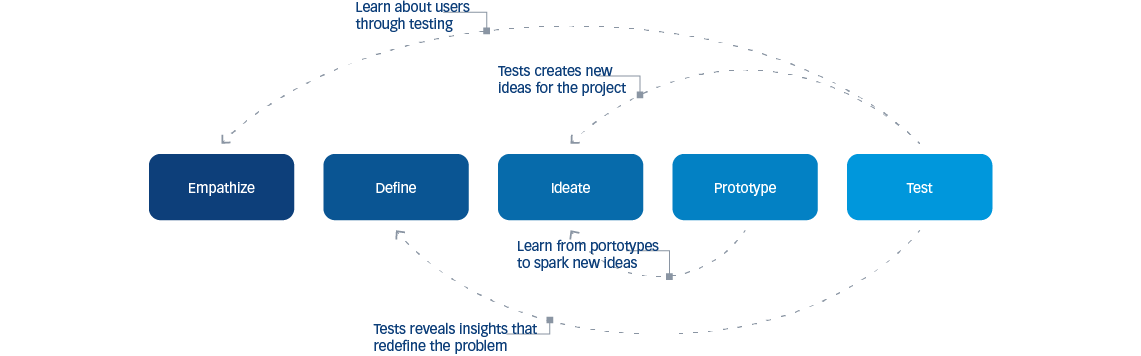

Figure 2: Design Thinking & Interaction Foundation

Accordingly, adopting User Experience (UX) design and optimization is essential for a solution’s success.

The role of UX designers is to design usable and intuitive products that starts with stakeholder meetings to gather requirements and develop an understanding of the product, and is followed by research and analysis, ideation, prototyping and testing, all to ensure that the product is well-designed and user-friendly. The continuous UX design process, which also extends to analyzing user reviews and feedback after the product is launched, ensures that the usability and efficiency of the product are always improved.

Figure 3: User Experience Design

This is particularly essential in an industry where fintech companies have already recognized the value of UX in attracting and retaining customers, improving overall productivity and sales, and more importantly, successfully competing with industry giants from financial institutions such as banks.

Which is why, financial institutions should prioritize UX design.

The demands of users have changed, competition within the industry has intensified, and what makes a financial product successful has expanded from security and functionality, to usability and convenience. So whether you are developing your payment solutions in-house or collaborating with a solution vendor to develop your next big product, make sure there is a UX design team on hand – otherwise, the product will only be half-way ready.