疫情在全球範圍內的傳播推動了銀行業數碼化需求的發展,數碼銀行平臺正走向舞臺中心。

下文將介紹數碼銀行帶來的潛在商業機會以及銀行業數碼化的未來趨勢。

趨勢

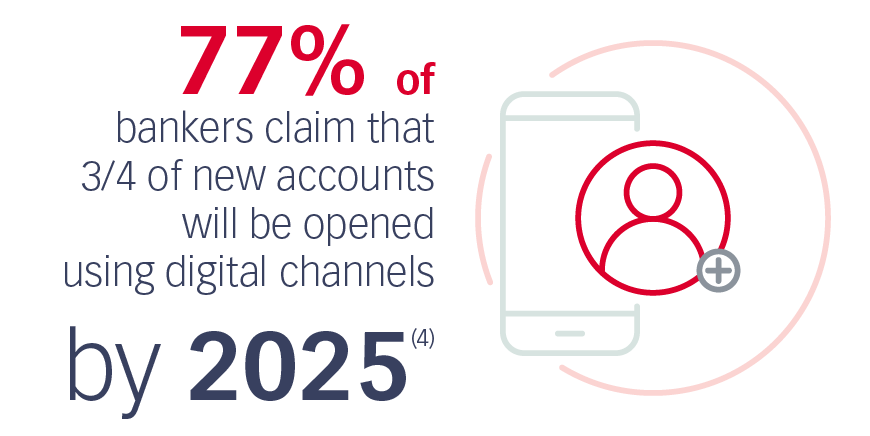

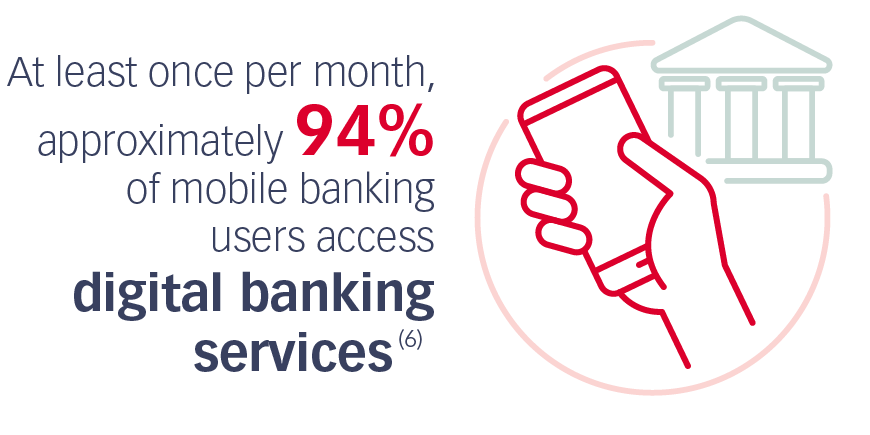

新技術的引入以及向無現金社會的遷移導致面向終端用戶和金融機構的數碼銀行前途一片光明。

2023年前3大零售銀行趨勢(5) 均可受數碼銀行驅動:

機會

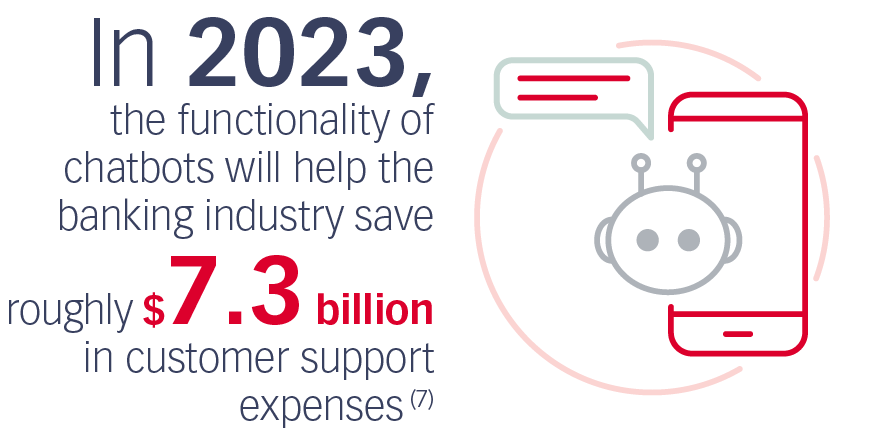

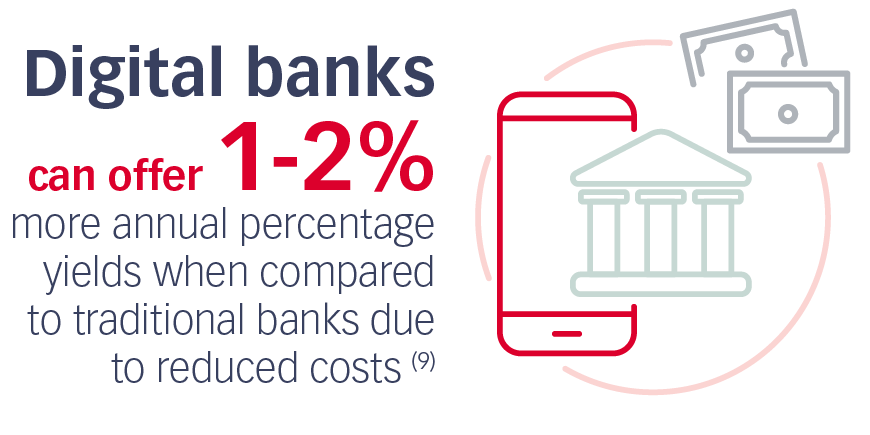

數碼銀行潛能無限,可提升銀行業務流暢性,降低成本並增加收入來源。

參考

- https://www.bloomberg.com/press-releases/2022-09-19/digital-payment-market-to-hit-opportunities-worth-361-30-billion-by-2030-grand-view-research-inc

- https://www.globaldata.com/media/thematic-research/banking-will-centered-around-smartphone-2030-countries-become-functionally-cashless-says-globaldata

- https://www.juniperresearch.com/press/digital-banking-users-to-exceed-3-6-billion

- https://thefinancialbrand.com/news/banking-branch-transformation/bank-branches-omnichannel-digital-delivery-trends-132770

- https://thefinancialbrand.com/news/banking-trends-strategies/top-10-retail-banking-trends-and-priorities-predictions-2023-157672

- https://www.enterpriseappstoday.com/stats/digital-banking-statistics.html

- https://www.juniperresearch.com/press/bank-cost-savings-via-chatbots-reach-7-3bn-2023

- https://www.consumeraffairs.com/news/online-banking-has-become-more-widespread-among-consumers-survey-finds-103119.html

- https://www.investopedia.com/articles/pf/11/benefits-and-drawbacks-of-internet-banks.asp