Digital transformation presents both unprecedented opportunities and formidable challenges for financial regulators worldwide. From the complexity of financial services to evolving financial crimes, the rapid adoption of digital payments and the rise of fintech, all posing significant challenges to the effective oversight and control of the monetary landscape. To thrive and successfully navigate these hurdles, financial regulators are encouraged to embrace regulatory innovation, enhance risk management and promote financial stability through strategic partnerships and advanced technologies.

This article explores how regulators can leverage innovation and technology to navigate these challenges and foster sustainable growth in the digital era. Presented in the article are real-world use cases and an outline of how ProgressSoft has been supporting the central banking innovation.

Digital Transformation in Payment Infrastructure

Regulatory authorities are pivotal in establishing future-proof payment infrastructures that foster interoperability among ecosystem partners, driving consumer adoption. Below are components of payment infrastructure enabling digital transformation and efficient business processes:

-

Enhancement of Interbank Retail Payment Systems

Upgrading interbank retail payment systems is essential for improving bulk business-to-person, person-to-business and government-to-person payment use cases, thereby enhancing payment processing for governments, businesses and consumers alike. These upgrades lead to increased efficiency in overall service delivery within the country. Key enhancements should encompass:

- Migrating payment messages to ISO 20022 to utilize a richer data structure.

- Implementing support for electronic mandates to facilitate direct debit payments.

- Developing a framework to support the Wage Protection System.

- Establishing an Application Programming Interface (API) framework to foster fintech innovation.

-

Facilitation of Instant Payment Utilization

Instant payment networks have proven to boost e-payment penetration, especially in the person-to-person segment, and have become a viable alternative payment method for merchants and e-commerce transactions in some emerging markets. Designing a futuristic instant payment system involves:

- Creating an inclusive interoperable platform that supports all stakeholders, including banks, merchants and payment service providers.

- Implementing a smart addressing system with multiple addressing methods such as mobile numbers, alphanumeric addresses and other national identification numbers.

- Exploring the viability of separating the account-holding institution from the Payment Initiation Service Provider (PISP).

- Defining a national QR code standard to promote interoperability among ecosystem partners.

-

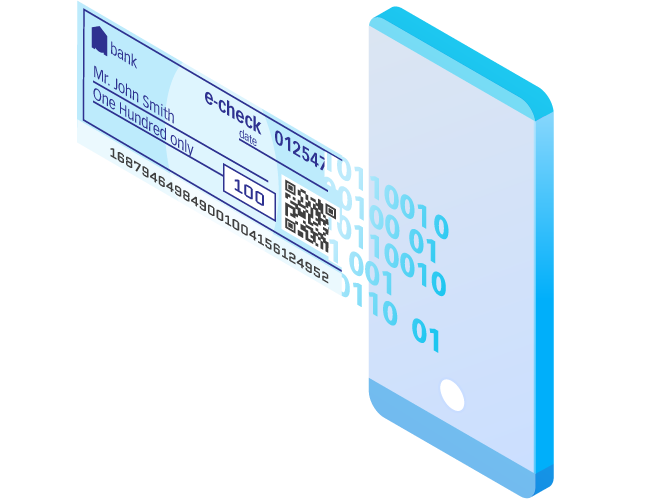

Digitalization of Check Clearing

Traditional check clearing processes entail high operational overheads for operators and participant banks, consuming a significant share of banks' workforce. Therefore, transitioning from paper-based to a public key infrastructure (PKI)-based e-check platform can streamline operations by replicating existing check issuing and clearing processes while eliminating inefficiencies. Importantly, the electronic system should operate alongside the existing paper-based check platform during the transition period to avoid disruption.

-

Adoption of Dispute Management Frameworks

Establishing a streamlined dispute management framework is essential to navigate the complex network of interbank retail payment systems and promptly address complaints from diverse stakeholders. An effective dispute management framework should include:

- Facilitating a versatile workflow capable of accommodating different processes associated with various retail payment systems and payment types.

- Ensuring strict enforcement of turnaround time definitions to maintain consistency in issue resolution.

- Implementing an effective arbitration framework to resolve disputes that cannot be resolved through mutual agreement among ecosystem participants.

- Effectively handling adjustment accounting entries among participants, ensuring accuracy and transparency in financial transactions.

The digital transformation of a domestic payment infrastructure requires meticulous attention to regulatory, technological and operational aspects. In addition to addressing these concerns, it must also catalyze broader digitalization within the banking sector and promote a comprehensive upgrade throughout the payment ecosystem.

Innovative Use Cases in Retail Payment Infrastructure

Nationwide implementations by central banks empower financial institutions to leverage retail payment infrastructure, driving substantial improvements in business efficiency and service delivery, ultimately enhancing the customer experience. Here are key examples that illustrate how national-level digital transformation can catalyze significant advancements in the banking industry:

-

Enhancing Credit Transfer for Salary Processing

The retail interbank payment platform can seamlessly support integrated salary processing, leveraging Straight-Through Processing (STP) capabilities while ensuring compliance with regulatory norms and workforce regulations. This data, with appropriate consent for data sharing, can also be utilized to establish comprehensive customers’ credit worthiness within the ecosystem.

-

Streamlining Credit Transfer for Government Benefits

Many governments face substantial costs associated with disbursing benefit transfers to citizens through non-digital and non-integrated processes, resulting in inefficiencies and lack of transparency. The retail interbank payment platform can facilitate a central mapper system, utilizing multiple identifiers to initiate bulk benefit transfers by government agencies, thereby offering a cost-effective, fast and transparent solution that minimizes the risk of misuse and misconduct.

-

Digitizing Loan Repayment through Direct Debit

Traditional loan repayment methods involving paper-based checks entail high operational costs, inefficiencies and susceptibility to fraud. Implementing direct debit with e-mandates can revolutionize this process, making it fully digital with STP, and eliminating operational hassles for both financial institutions and customers.

-

Enabling E-channel Payments

The retail interbank payment platform empowers financial institutions to offer digital banking services to customers, enabling round-the-clock payments and ensuring seamless interoperability across participating institutions.

-

Facilitating Instant Peer-to-peer Payments

Instant payment platforms serve as catalysts for promoting a cashless economy by facilitating instant and seamless micro and low-value payments among individuals and businesses.

-

Supporting Peer-to-Business Payments

Instant payment networks are increasingly utilized as alternative payment channels for peer-to-business transactions, particularly QR code-based scan-and-pay methods and in-app digital payments.

-

Introducing Secure E-checks

PKI-based e-checks transform the traditional check processing method, transforming it into a fully digital, secure and cryptography-enabled process. This advanced system covers the entire lifecycle of an e-check, from issuance to clearing, ensuring maximum security and efficiency throughout.

-

Leveraging Digital Intelligence

Data intelligence emerges as a valuable byproduct of digital transformation within the ecosystem. Properly governed data unlocks numerous opportunities for market intelligence, Buy Now, Pay Later services, and other cross-selling initiatives, ultimately driving economic growth.

-

Driving Open Banking Transformation

Each future-proof national payment system deployed by the central bank can form the building block for establishing a resilient Open Banking platform nationwide, driving increased innovation and transformation of business services.

These innovative use cases showcase the transformative potential of digital payment infrastructure, pushing technology boundaries and prompting regulatory frameworks to evolve for enhanced security and privacy. Maintaining balance between innovation and regulation is critical for the success and sustainability of these advancements.

Regulatory Challenges Across Borders

While establishing a robust digital payment infrastructure is paramount, addressing regulatory and operational challenges across borders is equally critical. Here are some essential considerations:

-

Enforcing Effective Regulation

Effectively navigating digital transformation in payment processing demands adherence to comprehensive regulations, encompassing payment system laws, data protection and localization laws, as well as Anti-Money Laundering (AML) and sanction screening regulations.

-

Adopting Impartial Charging Policies

The adoption of new payment rails depends significantly on fair charging policies. These policies should balance the interests of all stakeholders, with regulators and operators ensuring alignment with national objectives.

-

Gaining Governmental Support for Adaptation

New systems often require initial support to gain wider acceptance. Regulators and government agencies may need to explore options such as making initial investments or infusing viability funds to ensure commercial viability.

Overcoming regulatory challenges is crucial and requires coordinated efforts and a deep understanding of both technology and legislation. Innovators like ProgressSoft shape the trajectory of digital transactions in central banks as they drive the transition to streamlined and secure payment environments by encouraging institutions to adopt emerging technologies.

ProgressSoft Impact on Central Banks

Since 1989, ProgressSoft has forged partnerships with government agencies, central banks and financial regulators, gaining valuable insights into regulatory challenges. Leveraging this expertise, ProgressSoft has developed adaptable solutions to meet evolving needs.

A cornerstone of ProgressSoft's design and solution architecture is providing powerful oversight capabilities for regulatory compliance monitoring teams at central banks and federal reserves which has been effectively enhancing financial oversight.

ProgressSoft's impact extends beyond central banks' oversight objectives, influencing financial inclusion strategies and fostering innovation within the financial sector. Additionally, ProgressSoft remains committed to enhancing regulatory capabilities, expanding access to financial services, and driving innovation at the national level. These efforts span key areas where ProgressSoft has made a significant impact.

-

Strengthened Oversight and Regulation Capabilities

In 1989, ProgressSoft launched the world's first national-level Electronic Check Clearing solution, revolutionizing the industry with its support for electronic image-based check clearing. By 2001, the first of nine national implementations of this groundbreaking solution was launched, significantly enhancing oversight through advanced online real-time monitoring and reporting, thereby eliminating delays associated with paper-based reporting.

Expanding its offerings, ProgressSoft has broadened its central banking solutions portfolio to encompass Interoperable Instant Payments, Automated Clearing House, Electronic Bill Payment and Presentment, Salary Processing, Dispute Management and more. Each solution facilitates instant updates, enabling central banks to promptly respond to urgent situations and support their oversight objectives effectively.

-

Improved Financial Inclusion and Accessibility

With vast experience in nationwide implementations, ProgressSoft introduced its Interoperable Mobile Payment Switch. This solution serves as both the central bank's regulatory control point and mobile payments switch, streamlining financial processes and promoting financial inclusion by expanding access to banking services. Additionally, ProgressSoft implemented a national registry at the regulatory firm level to enhance trust in the mobile payments ecosystem.

Committed to innovation, ProgressSoft anticipated the need for a 24x7 instant payment solution which led to the development of the Interoperable Instant Payments System, capable of handling over 2000 transactions per second and ensuring transaction finality in milliseconds.

ProgressSoft's latest mission is to consolidate several of its payment instruments into a single, comprehensive platform encompassing credit transfers, mobile payments, microtransactions, low-value payments and large-scale transfers. This initiative is currently underway in multiple countries worldwide, fostering greater financial inclusion.

-

Advanced Financial Innovation Efforts on a National Level

In the ever-evolving landscape of technology, ProgressSoft strategically invests in cutting-edge advancements in financial technology, encompassing but not limited to, machine learning (ML) and artificial intelligence (AI).

For instance, ProgressSoft’s Intelligent Signature Recognition solution leverages advanced ML and AI models to continuously refine signature verification processes. By utilizing extensive datasets and learning from historical interactions, it enhances accuracy and effectively detects potential forgeries of handwritten signatures.

Another notable example is ProgressSoft's latest innovation, Message Depot, which represents state-of-the-art technology in modern extract, transform and load (ETL) practices. Featuring an exceptionally fast full-text search engine, it aggregates data from various database sources and systems. This facilitates ML/AI solutions that improve business operations in numerous ways, including advanced chatbots, real-time anomaly detection and predictive analytics for customer behaviors.

ProgressSoft remains committed to leveraging emerging technologies for pioneering solutions, ensuring that its offerings stay at the forefront of the financial industry's evolving needs, driving innovation and efficiency within the sector.

Conclusion

In summary, the digital transformation of central banks' payment infrastructure marks a pivotal step towards modernizing the financial ecosystem. By embracing innovative solutions and fostering collaboration with the right technology partners, central banks catalyze widespread improvements in the financial landscape. As central banks continue to embrace digitalization, the potential for innovation in the financial sector is boundless, promising a future marked by enhanced efficiency, accessibility and security in financial transactions.

Subscribe to The ProgressSoft Blog

Related Products

PS-MDepot

PS-DMS

Prompt e-Check