The earliest forms of digital banking were back in the 1960s, where the mere use of ATMs and cards was considered as such. Fast forward to 2020, with always available internet access, significantly improved broadband, widespread of smartphones, and online banking becoming the new norm as customers expect to access and conduct all types of financial and non-financial services digitally, remotely and instantaneously.

But what does digital banking mean today, and is it imperative or optional? We had a quick chat with ProgressSoft’s Business Development Officer, Carole Elias, on the topic. Here is the full conversation.

Q: What does digital banking mean today?

Carole: In simple terms, it is the automation of traditional banking services that enable retail and corporate customers to access banks’ products and services via online channels (web and mobile).

Q: What does the move towards digital banking look like today?

Carole: The move towards digital banking is global, banks are pursuing great initiatives to shift interaction with clients from physical to digital, be it through digitizing services, changing branch working hours, or availing digital payment methods.

When we look back on what traditional banks have changed in the past year, we can see that 60% closed or shortened opening hours of branches, 34% implemented fully digital processes and 18% launched contactless payment methods.

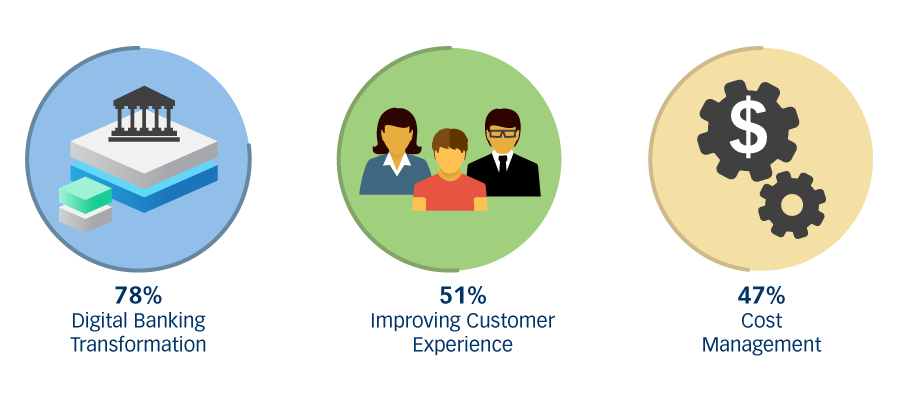

Looking forward, we can also see that digital banking transformation is the leading objective among the top three priorities for banks in the year 2022.

So, we can safely conclude that the move towards digital banking today is not only rapid, but more customer-focused than ever witnessed in history.

Q: What is the reason behind this rapid digital shift, and what is driving banks towards it?

Carole: The shift towards digital banking has inevitably been driven by changing market demands and customer expectations. I would say that besides retaining competitive edge and market share, banks are also eager to attain new benefits of digital banking which include:

- Expanded geographical reach: digital banking is considered a much lower-cost geographic expansion; you get to reach a much wider audience without having to open new branches.

- New revenue streams: digital banking platforms are helping create new revenue streams for banks by allowing them to use the data to build meaningful customer engagement and develop new services.

- Paperless transactions: one of the biggest drawbacks of traditional banking was the overly placed importance on paper. Banking has become paperless with the development of digital banking.

- Reduced cost: with the elimination of paper-based and manual processes and time spent by banks’ employees, significant costs are reduced for banks.

- Convenience: providing customers with utmost experience is a priority for banks and digital banking ensures that customers can conduct all types of services remotely and with 24x7 availability of access to banking functions.

It’s also vital to mention that competition has massively increased in the financial landscape, which is accelerating the rate in which banks are migrating to digital.

Q: Why has competition massively increased in the financial landscape?

Carole: In the past decade or two, banks were used to competing with their bank peers only, which, yes, did cause strong competition, however, all banks face the same limitations in terms of service fees and charges, time to market, etc.

Now however, the competition is much stronger with the introduction of other types of financial institutions to the market such as neobanks, challenger banks, fintechs, and digital-only banks. Banks are not competing with other banks only anymore, the competition has expanded greatly, and that is why banks are acting fast: in order not to lose any market share.

Q: Do banks that simply avail online services mean that they are successfully providing digital banking services?

Carole: Unfortunately, not. For a bank to be considered as providing digital banking; they need to offer:

- Full coverage of all services: you need to cover the full spectrum from onboarding retail and corporate customers and all the way through to providing all your front-office services remotely, financial and non-financial services that is.

- 24x7 availability of services: availability of services around the clock. Customers should no longer be limited by the banks’ opening hours and should be able to conduct services at any hour.

- Services beyond traditional banking: introduce new services in line with the new digital lifestyle such as location-based advertisement, gamification, personal financial management, and predictive analysis based on customer behavior.

- Unified customer journeys: with the elimination of paper-based and manual processes and time spent by banks’ employees, significant costs are reduced for banks.

- Intuitive User Experience (UX): the aim of UX is to create a digital financial service that matches users’ needs with banking capabilities that are easy and pleasant to use.

- Attractive User Interface (UI): innovative and attractive UI design in digital products should really be regarded as table stakes. UI should be user-centered, meaning being ultimately based on understanding what users want and need from your product.

- Efficient services: time is of great essence and the less time or action the user needs to complete any action the better, so you basically need to reduce input effort, less is more. Be as direct and as clean as possible.

It is all about creating the right digital experience. If customers find it difficult to get to what they need from the services you are providing, they might simply give up entirely and go elsewhere.

Q: Any advice for banks shifting to digital banking services?

Carole: I would advise banks to act fast and start now! Talk to your customers, research their financial behaviors, and collect all possible feedback to find real pain points.

If I may say so, several years of success mean nothing when looking at modern banking today; if you want to stay ahead of the curve, you need to act fast; digital banking is no more optional but imperative.

- Digital Transformation

- Banks

- User Experience

- Fintechs

- Corporate Banking

- Online Banking

- Retail Banking