Real-Time Gross Settlement System

PS-RTGS

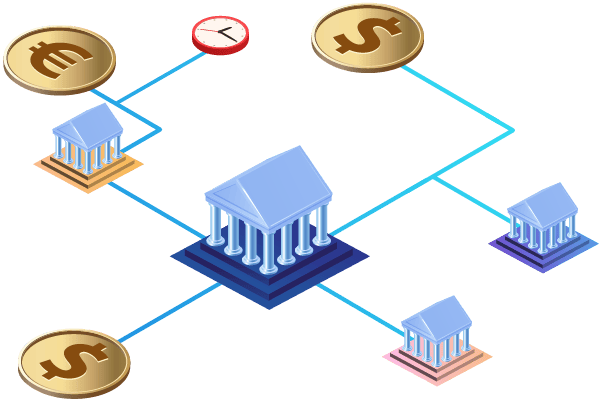

ProgressSoft’s Real-Time Gross Settlement system empowers central banks and monetary agencies with the means to control large-value payment transactions in a safe, reliable and irrevocable environment.

The solution utilizes cutting-edge technology that is compliant with international standards and liquidity risk management with its main role being the settlement of interbank payment transactions.

Features

Modular Design

Compliance with International Standards

Full Financial Transactions Support

More features

Interoperable Structure

PS-RTGS fully interoperable with Automated Clearing House solutions and can be readily interfaced with other systems for retail payments.

Liquidity Management

PS-RTGS provides a set of liquidity management facilities that allow central banks to provide liquidity to participants and enables participants to efficiently monitor and manage their liquidity.

Multilingual and Multicurrency

PS-RTGS is a multilingual, multi-currency solution that meets the needs of the central bank and participant banks with respect to auditing, monitoring and reporting.

Account Management

PS-RTGS incorporates an accounting system that allows participant banks to hold their balances and reserves. The system allows for the management of participants’ settlement and collateral accounts.

Securities Settlement

PS-RTGS offers a facility to carry out securities transactions such as the purchasing of bonds, equities and money market instruments.

Supervision

PS-RTGS enables the central bank to fine-tune the operations of the system to match the rules and regulations imposed by it on all participants in the network.

Seamless Deployment

PS-RTGS can be hosted at the central Bank where banks can seamlessly connect to the central system without having to install anything on their premises. If the regulation allows, banks and central banks can connect to PS-RTGS on the cloud.

Benefits

Accelerated Liquidity Flow

Automates large-value payments and reduces transaction costs, enhancing reliability and promoting economic activity

Mitigated Risks

Ensures the secure finality of settlement, mitigating settlement risk, liquidity risk, credit risk and systematic risk

Reduced Costs & Increased Revenues

Provides banks with same-day deployment of cash due to adjustable and continuous settlement sessions

Enhanced Circulation of Funds

Acts as a financial infrastructure that supports all economic activity including commercial activity and financial transactions

Fostered Financial Stability

Allows the central bank to enhance monetary policy, manage liquidity and address risks associated with the financial stability